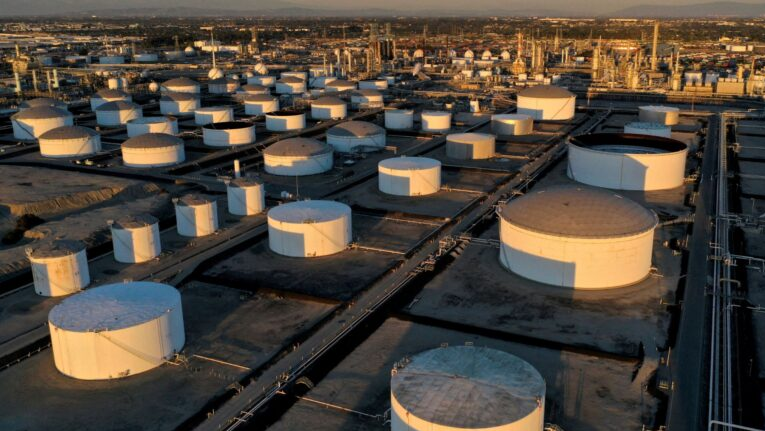

Crude Oil Prices Surge Over 7% Amid Escalating Israel-Iran Tensions and Supply Fears

News Mania Desk / Piyal Chatterjee / 14th June 2025

Global crude oil markets experienced a sharp rise on Thursday, June 13, 2025, as prices soared over 7% following a dramatic escalation in tensions between Israel and Iran. Brent crude, the global benchmark, climbed more than 7% during intraday trading, while U.S. West Texas Intermediate (WTI) crude also saw similar gains, triggering concerns about potential disruptions in oil supply from the Middle East.

The sudden surge was triggered after reports emerged that Israel had carried out airstrikes on Iranian military and nuclear targets in retaliation for a prior drone and missile attack by Iran. Although Iran’s energy infrastructure remained intact at the time, markets reacted strongly, fearing further escalation could jeopardize oil exports from the region, especially from the strategically critical Strait of Hormuz — a key maritime chokepoint through which nearly 20% of global oil passes.

Traders and analysts pointed to the risk of broader regional instability affecting oil supply chains. Iran, being one of the largest oil producers with an output of around 3.3 million barrels per day, holds a significant role in global energy markets. Any direct damage to its infrastructure or blockades in shipping lanes could send oil prices skyrocketing.

The impact extended beyond oil markets. Global equity indices took a hit, with the Dow Jones Industrial Average falling by over 700 points, and the S&P 500 and Nasdaq also registering losses as investors moved away from riskier assets. Meanwhile, traditional safe havens like gold and government bonds saw a rise in demand.

Experts believe the market could witness even sharper price increases if hostilities deepen or if there are attacks on oil transport routes. There is also speculation that the U.S. might release reserves from the Strategic Petroleum Reserve or call on OPEC+ to increase production to stabilize global prices.

This sudden geopolitical flare-up has brought back energy security concerns to the forefront, with markets bracing for further volatility in the days ahead.