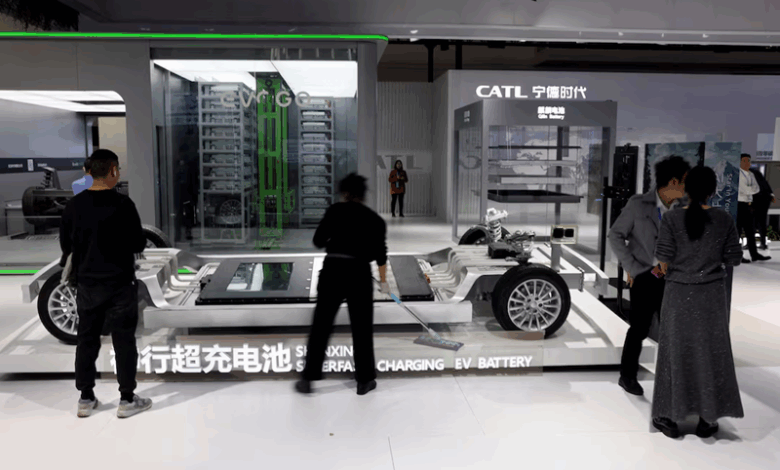

China’s CATL to raise at least $4 billion in Hong Kong listing

News Mania Desk / Piyal Chatterjee / 12th May 2025

Chinese battery producer CATL has announced plans to secure at least HK$31.01 billion ($3.99 billion) through its Hong Kong listing, as stated in its prospectus submitted on Monday, marking the largest global listing thus far in 2025.

The battery manufacturer for electric vehicles is offering 117.9 million shares at a peak price of HK$263 for each share, as outlined in documents submitted to the Hong Kong Stock Exchange. The total value of the transaction might rise to around $5.3 billion if the option to adjust the offer size and the greenshoe option are utilized.

CATL’s stock in Shenzhen climbed 3.6% on Monday following the announcement of the Hong Kong agreement, hitting a six-week peak. The increase exceeded a 0.9% rise in China’s blue-chip CSI300 opens new tab index.

According to Dealogic data, CATL’s $4 billion fundraising makes it the largest listing globally this year, surpassing JX Advanced Metal’s $3 billion IPO in Tokyo from March. In Hong Kong, the stock offering will be the biggest since Midea Group collected $4.6 billion the previous year.

According to the prospectus, over 20 key investors, spearheaded by Sinopec and the Kuwait Investment Authority, have committed to purchasing approximately $2.62 billion in CATL shares.

According to two sources with direct knowledge of the situation, demand from investors has already filled the order book for the institutional tranche of 109.1 million shares. The sources were unable to be identified while talking about details that had not yet been released.

CATL did not promptly reply to a request for feedback regarding the demand. The option to adjust the offer size allows for an increase of up to 17.7 million shares, potentially raising an extra HK$4.65 billion ($598.00 million). There exists a greenshoe option to offer an additional up to 17.7 million shares.